Table of Contents

When people need to begin to manage their money, they may think that they have to open an online checking account or an online savings account. Each type of account helps them realize different goals, so they may not need to choose between the two. Most people may find that having an online checking and savings account is the best option for them.

What Is an Online Checking Account?

An online checking account is an account that you open at an online financial institution for the purpose of paying your bills. It used to be the means by which you could make payments with paper checks, but it has expanded to include debit card payments and electronic wire transfers. In short, a checking account is a liquid account that you use for daily expenses.

Checking accounts are a useful and easy way for people to spend their money, and they don’t have to worry that their transactions will be limited. These accounts may have fees, but an online checking account may have fewer fees than the traditional banks. According to the experts at SoFi, using their services mean, “No overdraft fees. No minimum balance fees. No monthly fees. Plus, 55,000+ fee-free ATMs within the Allpoint® Network.”

What Is an Online Savings Account?

An online savings account is an account that you open at an online financial institution for the purpose of saving money. It is for money that you are not going to spend on daily expenses or bills. Because a savings account is not a spending account, the financial institution may limit the number of withdrawals and transactions you can make each month. You may not be able to have a debit card attached to a savings account.

The Differences between an Online Checking Account and an Online Savings Account

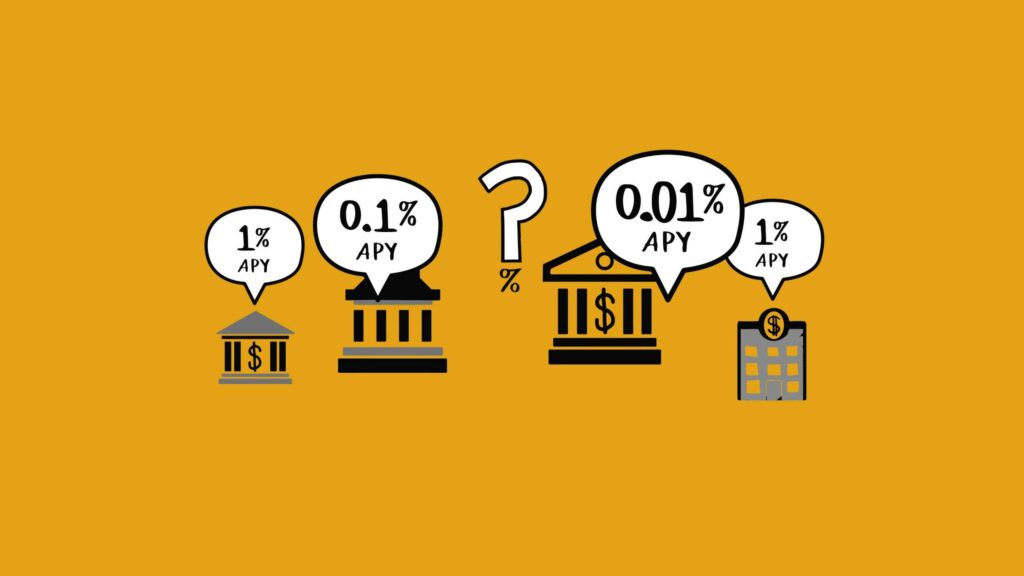

Financial institutions encourage their customers to keep their money in their savings accounts by giving them the opportunity to earn interest on the account. They are less likely to earn interest on a checking account. The interest rate that savers can earn with an online savings account is much higher than the interest rate they would earn with a traditional bank. Savers may even be able to earn as much as 20 times more than they would earn with a traditional bank.

Because checking accounts are accounts that are meant for money that the customer will spend, these accounts don’t come with a limited number of withdrawals people can make each month. Savings accounts, on the other hand, do have these restrictions. Customers will be limited to six withdrawals per month unless they use an ATM. A savings account can also be used for overdraft protection of the checking account.

An online checking and savings account can be very similar, but they are different because the purpose of each account is different. Consumers must prepare before they open a checking account or a savings account so that they can find out if they can waive the fees that financial institutions charge them. Also, they must make sure that they determine the interest rate on their savings accounts so that they can earn the most money over time.